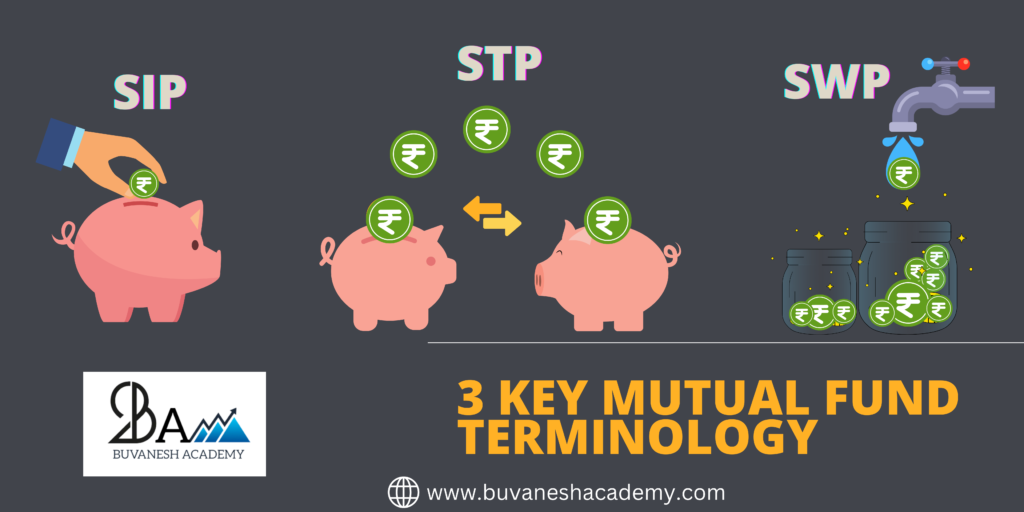

SIP, STP, and SWP are three different investment strategies used in the context of mutual funds. Each strategy serves a specific purpose and can be utilized based on an investor’s financial goals and risk tolerance. Here’s the difference between SIP, STP, and SWP:

SIP (Systematic Investment Plan):

SIP is an investment strategy where an investor commits to investing a fixed amount of money at regular intervals (usually monthly) into a mutual fund scheme. The primary objective of SIP is to promote disciplined investing and take advantage of rupee cost averaging.

Regardless of the fund’s NAV (Net Asset Value), the investor buys a fixed number of units with each SIP installment. When the NAV is high, fewer units are purchased, and when the NAV is low, more units are purchased.

Over time, this strategy can help mitigate the impact of market volatility and potentially lead to better long-term returns.

STP (Systematic Transfer Plan):

STP involves systematically transferring a fixed or variable amount of money from one mutual fund scheme (the source fund) to another (the target fund).

The primary goal of STP is to manage risk and optimize returns by gradually moving investments from one type of fund to another.

This is particularly useful when an investor wants to switch from a higher-risk fund (e.g., equity) to a lower-risk fund (e.g., debt) or vice versa.

STP helps reduce the impact of market volatility and allows for a smoother transition between different asset classes.

SWP (Systematic Withdrawal Plan):

SWP is a strategy where an investor withdraws a fixed or variable amount of money from a mutual fund scheme at regular intervals.

SWP is used by investors who want to generate a regular income stream from their investments while keeping their principal amount invested.

It’s often employed by retirees or those needing supplementary income. The withdrawals can be made from the gains or appreciation in the fund, and they can be set up to align with the investor’s income needs. SWP allows investors to maintain exposure to the market while receiving a predictable payout.

In summary:

- SIP is about investing a fixed amount at regular intervals to take advantage of rupee cost averaging.

- STP involves transferring funds from one scheme to another to manage risk and optimize returns.

- SWP allows for systematic withdrawals from a fund to generate a regular income stream while keeping the principal invested.

Each of these strategies has its own advantages and considerations. They can be used in combination to create a comprehensive investment plan that aligns with an individual’s financial goals and risk tolerance.

It’s important to consult with a financial advisor to determine which strategy or combination of strategies is suitable for your specific circumstances.