Financial planning has several advantages that can improve a person’s financial well-being. Here are five major advantages of financial planning:

Goal Achievement:

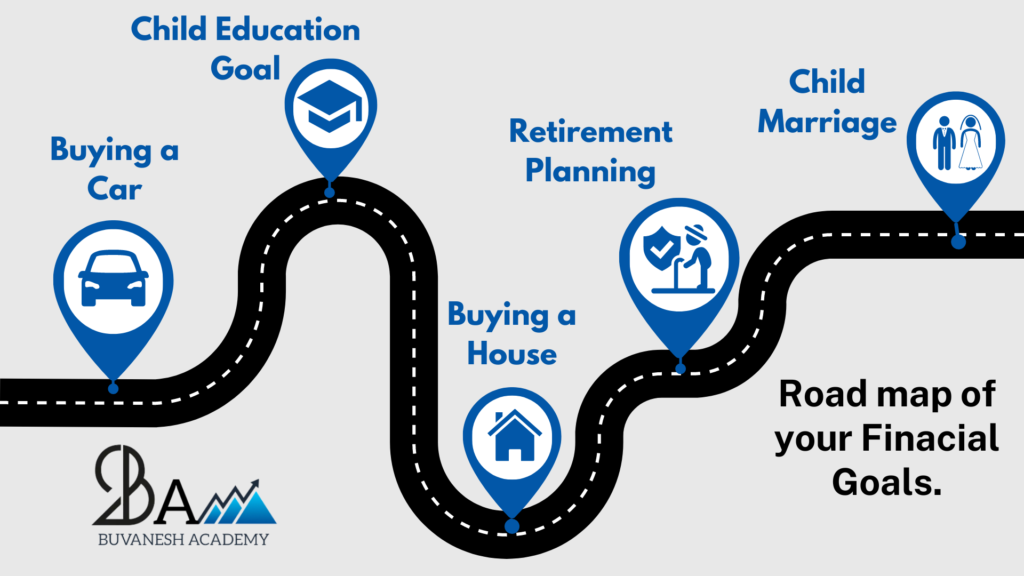

Financial planning assists individuals in defining their financial objectives, whether they are purchasing a home, saving for retirement, starting a business, or supporting the school. Individuals can identify the essential procedures and tactics to attain these goals by developing a detailed plan. Financial planning gives a road map that increases the possibility of meeting financial goals.

Better Money Management:

Financial planning involves looking at current income, costs, and assets in order to create a budget and spending plan. It enables people to obtain a better grasp of their cash flow and how to manage their money more effectively. Financial planning enables individuals to make informed decisions and build healthy financial habits by analyzing expenses, identifying areas of overspending, and prioritizing savings.

Management of Risk:

Financial planning takes into account potential hazards and assists individuals in protecting themselves and their loved ones from unanticipated emergencies. This includes strategies such as life, health, disability, and property insurance. Financial planning provides a safety net by addressing potential risks, promoting financial stability, and protecting assets in the case of emergencies or unexpected circumstances.

Wealth Accumulation:

Financial planning is concerned with the accumulation of wealth over time. It involves assessing risk tolerance, evaluating investment possibilities, and establishing an investing strategy customized to an individual’s goals and circumstances. Financial planning strives to maximize wealth growth and long-term returns by utilizing good investing ideas and exploiting the power of compounding.

Retirement planning:

Retirement planning is an important component of financial planning. Evaluating future income needs, defining retirement savings objectives, and strategizing the most efficient approach to develop a retirement nest egg is all part of the process.

Conclusion:

Overall, financial planning offers individuals a comprehensive approach to managing their finances, enabling them to make informed choices, manage risks, and work toward long-term financial security.

What have you done so far to achieve these goals? Where are you at with these goals? Our Proven Processes enable you to achieve each milestone systematically.